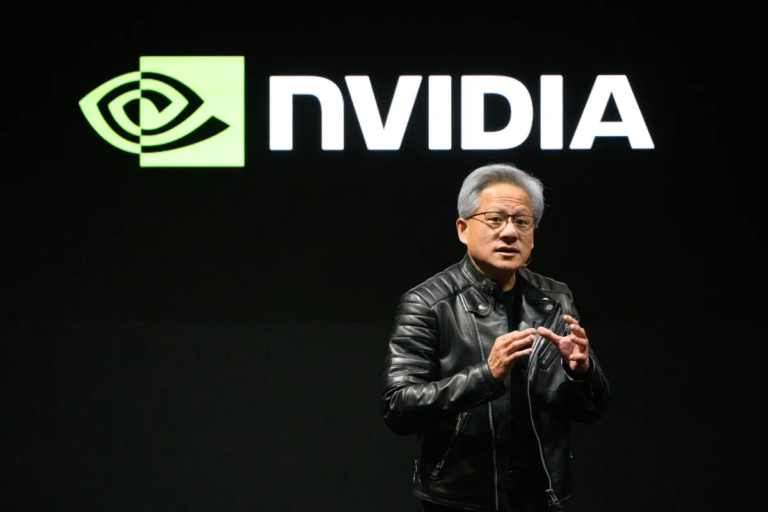

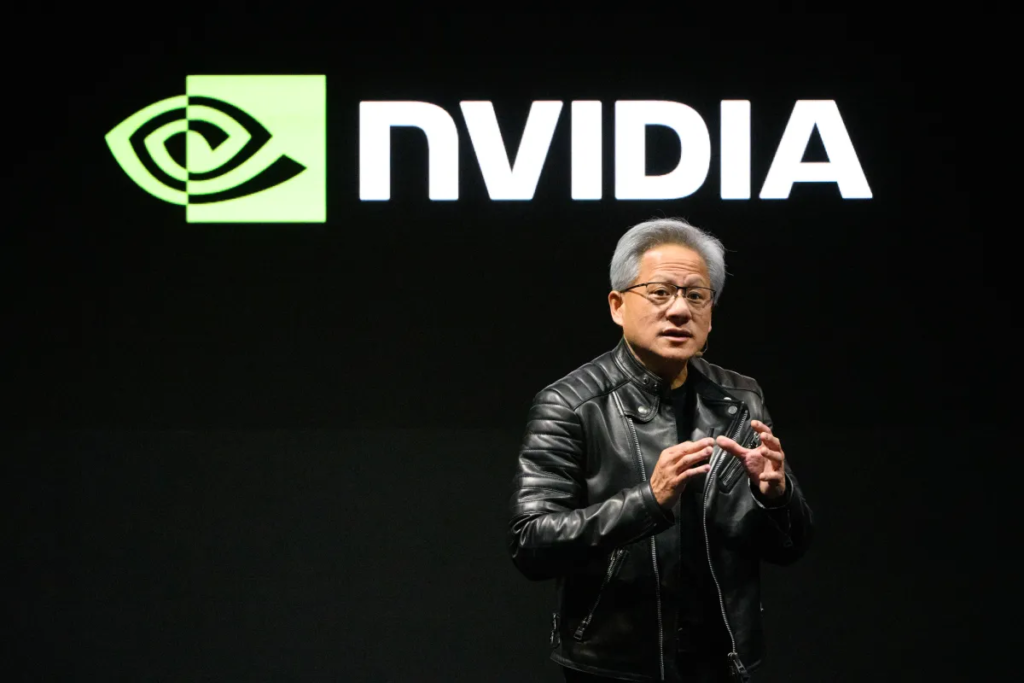

In a recent interview, Nvidia CEO Jensen Huang addressed the market’s reaction to DeepSeek’s R1, an open-source reasoning model that sent shockwaves through the AI industry. Contrary to the widespread panic that followed R1’s release, Huang described the development as “incredibly exciting” and a catalyst for accelerating AI adoption. His insights shed light on why the market’s initial response may have been misguided and what this means for the future of AI and computing.

In this article, we’ll break down Huang’s perspective, explore the implications of DeepSeek’s R1, and analyze how this innovation impacts Nvidia and the broader AI ecosystem. Whether you’re an investor, a tech enthusiast, or simply curious about the AI landscape, this deep dive will provide valuable insights.

What is DeepSeek’s R1?

A Game-Changing Open-Source Model

DeepSeek’s R1 is an open-source reasoning model designed to make AI systems more efficient. By optimizing how AI models process and analyze data, R1 has the potential to reduce computational costs and improve performance.

Why It Shook the Market

When R1 was released, many interpreted it as a threat to companies like Nvidia, which dominate the market for AI compute resources. The assumption was that more efficient models would reduce the demand for high-performance chips, leading to a sharp decline in Nvidia’s stock price.

Jensen Huang’s Perspective: Why the Market Overreacted

R1 is a Catalyst, Not a Threat

In a pre-recorded interview with Alex Bouzari, CEO of DataDirect Networks, Huang explained why the market’s reaction to R1 was misplaced.

“I think the market responded to R1, as in, ‘Oh my gosh. AI is finished,’” Huang said. “It’s exactly the opposite. It’s [the] complete opposite.”

Huang argued that R1’s efficiency advancements are a boon for the AI industry, not a death knell for compute resources. By making AI models more efficient, R1 expands the possibilities for AI applications and accelerates adoption across industries.

The Importance of Post-Training

Huang also emphasized that while R1 improves pre-training efficiency, post-training remains a resource-intensive process.

“Reasoning is a fairly compute-intensive part of it,” he added. This means that even with more efficient models, the demand for high-performance computing resources—like those provided by Nvidia—will continue to grow.

The Market’s Reaction: A Temporary Setback

Nvidia’s Stock Plunge

Following R1’s release, Nvidia’s stock price dropped 16.9% in a single day, wiping $600 billion off its market cap in just three days. This dramatic decline reflected the market’s fear that R1 would reduce the need for Nvidia’s chips.

A Swift Recovery

However, Nvidia’s stock has since almost fully recovered, opening at $140 per share on Friday, just shy of its pre-R1 price. This rebound suggests that investors are beginning to align with Huang’s optimistic outlook.

Why R1 is Good for Nvidia and the AI Industry

Expanding the AI Market

Huang believes that R1’s efficiency advancements will drive broader AI adoption by making the technology more accessible and cost-effective. This, in turn, will increase the demand for compute resources, benefiting companies like Nvidia.

Encouraging Innovation

By pushing the boundaries of what’s possible with AI, R1 encourages further innovation in the industry. This creates new opportunities for Nvidia to develop cutting-edge solutions that meet evolving needs.

The Bigger Picture: What This Means for AI

A Shift in Focus

R1’s release highlights the growing importance of efficiency in AI development. As models become more complex, optimizing their performance will be crucial for scalability and sustainability.

The Role of Open Source

DeepSeek’s decision to make R1 open source is a significant development. It democratizes access to advanced AI tools, fostering collaboration and accelerating progress across the industry.

Expert Insights: What Analysts Are Saying

We reached out to Dr. Emily Carter, an AI researcher at Stanford University, for her take on the situation.

“Jensen Huang’s perspective is spot-on. R1’s efficiency improvements don’t eliminate the need for compute resources—they expand the possibilities for AI applications. This is a win-win for the industry and for companies like Nvidia that provide the infrastructure to support these advancements.”

What’s Next for Nvidia?

Upcoming Q4 Earnings Report

Nvidia is set to release its Q4 earnings on February 26, and industry watchers will be keen to see how the company addresses the market’s reaction to R1. Analysts expect Nvidia to highlight its resilience and continued growth in the AI space.

Long-Term Growth Prospects

Despite the temporary setback, Nvidia’s long-term prospects remain strong. The company’s leadership in AI compute resources positions it well to capitalize on the growing demand for high-performance chips.

A New Era of AI Innovation

DeepSeek’s R1 has sparked a lively debate about the future of AI and compute resources. While the market’s initial reaction was one of panic, Jensen Huang’s insights offer a more nuanced perspective. Far from being a threat, R1 represents an exciting opportunity to expand the AI market and drive innovation.

As Nvidia prepares to report its Q4 earnings, all eyes will be on how the company navigates this evolving landscape. One thing is clear: the AI revolution is far from over, and Nvidia is poised to remain at the forefront.